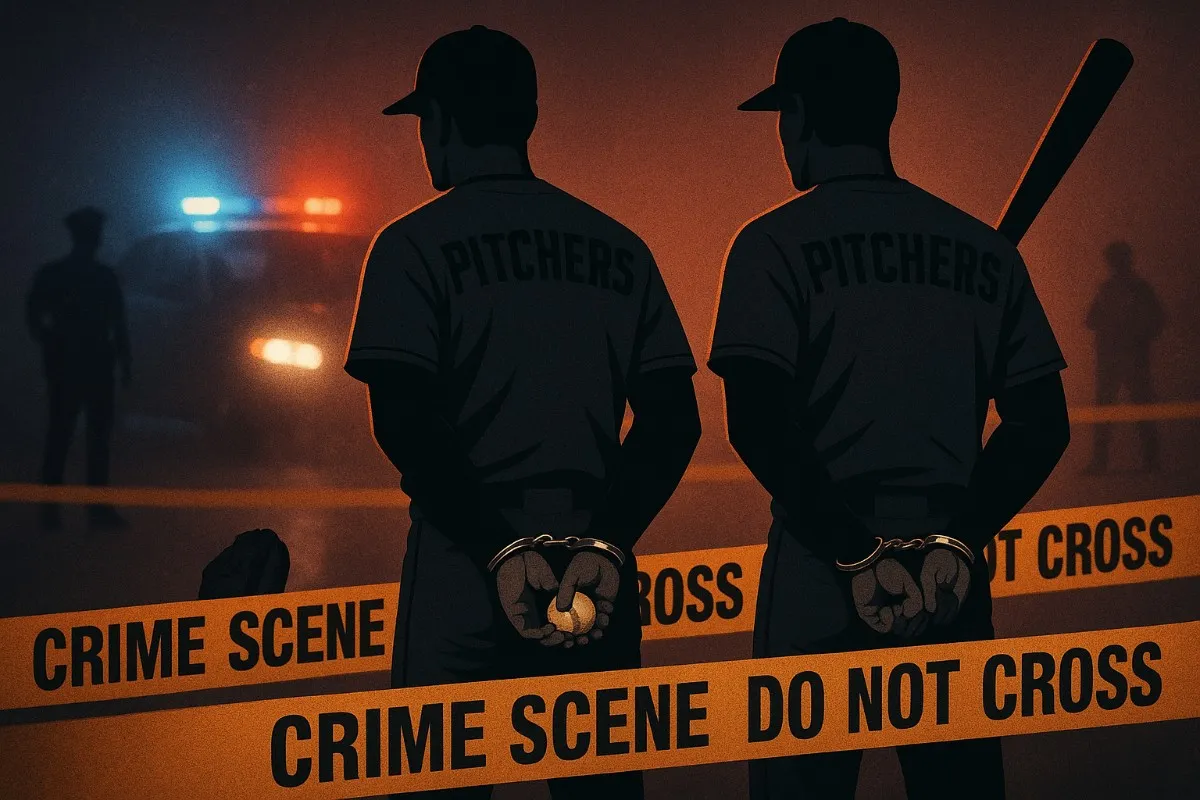

Cleveland Guardians pitchers are being charged with a crime because of a U.S. sports betting scandal

Two Cleveland Guardians pitchers have been charged in a U.S. sports betting fraud case that involved a rigged pitching system

Hopes for a Fed Rate Cut Fade, Putting More Pressure on U.S Markets

T

oday, U.S. markets went down because investors were less sure that the Federal Reserve would lower interest rates.As traders changed their minds about what they thought about monetary policy, people became more worried that interest rates would stay high longer than they had thought.This change made major indexes more unstable and made people even more unsure about how the economy was doing overall.

The market is nervous because they don't know if rates will go down

Stocks have done worse because of this uncertainty, especially in sectors that are sensitive to interest rates, such as technology, real estate, and consumer discretionary.

The U.S.markets respond to policy uncertainty

The U.S. stock market fell across the board when hopes for a rate cut faded.Experts say that Wall Street is being careful because the Federal Reserve hasn't made its plans clear. A lot of investors are taking less risk because they think that rising borrowing costs could slow down earnings growth and make things harder financially.

Get the latest news right in your inbox. We never spam!

Things are less stable when feelings change

The mood in the market has changed because traders are starting to think about the possibility of high interest rates lasting for a long time.During the session, Treasury rates went up, which put more pressure on stocks and made people worry that liquidity might get tighter.

Some defensive sectors did better than others, but the market as a whole was still weak, which meant that more people were selling stocks.

Looking forward to economic news and what the Fed has to say

Investors will be watching for new signals from the Federal Reserve and waiting for more reports on inflation and jobs in the next few weeks.How policymakers handle the balance between keeping inflation in check and helping the economy thrive will have a big impact on whether the market downturn stabilizes or gets worse.

As hopes for a rate cut fade, traders are getting ready for more volatility for now.

03 Comments

Vestibulum euismod, leo eget varius gravida, eros enim interdum urna, non rutrum enim ante quis metus. Duis porta ornare nulla ut bibendum

Sed ac lorem felis. Ut in odio lorem. Quisque magna dui, maximus ut commodo sed, vestibulum ac nibh. Aenean a tortor in sem tempus auctor

Donec in ullamcorper quam. Aenean vel nibh eu magna gravida fermentum. Praesent eget nisi pulvinar, sollicitudin eros vitae, tristique odio.